In 2015, a seed was planted in Ashleigh Pengelly's mind to start a business.

The CEO and founder of Little Black Duck, wanted to share her culture through Aboriginal ceramic art.

"My intention of starting Little Black Duck was to share my culture with as many Australian homes as possible," Pengelly tells Mamamia. "My signature item is my hand-painted teapots. I just find them to be a great conversation starter – and sharing a cup of tea has a big significance to Aboriginal culture as well."

Before Little Black Duck, she admits she had never considered herself an artist, but her business came about through her professional career.

"I was running a creative program and working with Aboriginal creatives to turn their hobbies into a business," Pengelly explains.

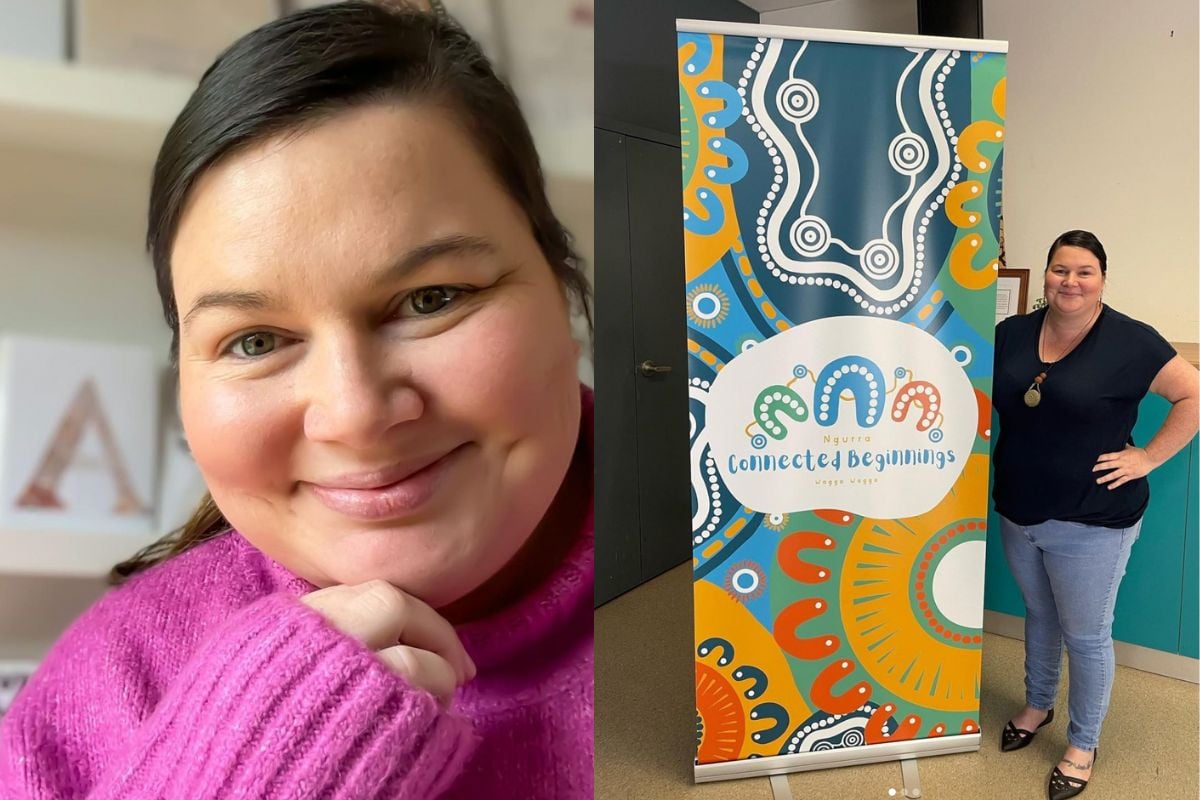

Image: Supplied.

Image: Supplied.